Why Gold?

Amidst monetary policy changes, fluctuations in Dollar Index, and economic data points, Gold has become a safe haven. With MCX Spot gold prices at Rs. 62,939 per 10 grams, Gold has delivered a robust return of 15% in 2023.

This trend is expected to continue to 2024.

There are multiple ways to invest in Gold, of which the popular ones being: Gold ETFs and Gold Funds.

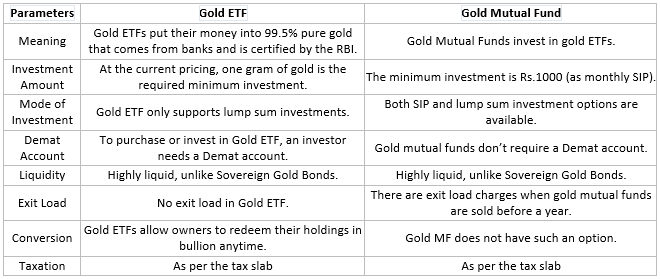

Gold Funds vs Gold ETFs

Both Gold Funds and ETFs are alternative methods of investing in Gold. As opposed to buying physical gold where the risk is higher, both from the perspective of purity and storage, it would be viable to invest here. There is added advantage of liquidity here as well. Further, Gold Funds and ETFs offer more. Here is a comparison of the same below -

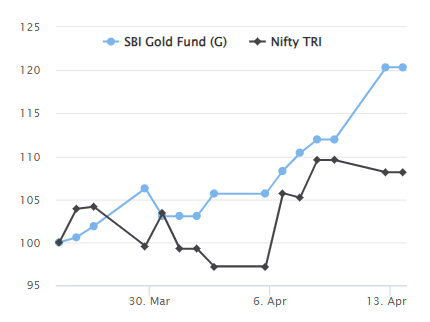

Performance of Gold Funds During Uncertain Times

Note: During Lockdown 1 from 25th March 2020 to 14th April 2020

From 25th March 2020 to 14th April 2020 during the first Lockdown Gold delivered 12.20% return higher than NIFTY TRI (top 500 stocks).

What is more suitable for you?

The suitability depends on the requirement, if you intend to invest in the SIP mode and are simply looking at Gold as an investment/hedge, then Gold Funds might be suitable.

Conclusion -

With Gold expected to offer considerable returns in 2024 due to the uncertainty across the world, One can consider Gold Funds.

But as Equities are expected to continue soaring, it may be a missed opportunity.

So, don’t you think it’s time to consider Multi-Asset Investing? To know more, click here.

To invest in Gold Funds, contact us at support@finhancers.com or +91 88840 03034

Or

Fill the form - https://bitly.ws/34Kmw

Source: Economic Times

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully and contact your financial advisor for relevant information before making a decision.